With a constant buzz over AI advancements, heightened cyber risk and a continued focus on digitalization, it would seem those in the technology space would be optimistic about the future.

But not according to the CIOs we polled the last week of July as part of StrategicCIO360’s third-quarter CIO Confidence Index. Instead, our survey found CIOs across the country concerned about what the current environment holds for their sector—and business in general.

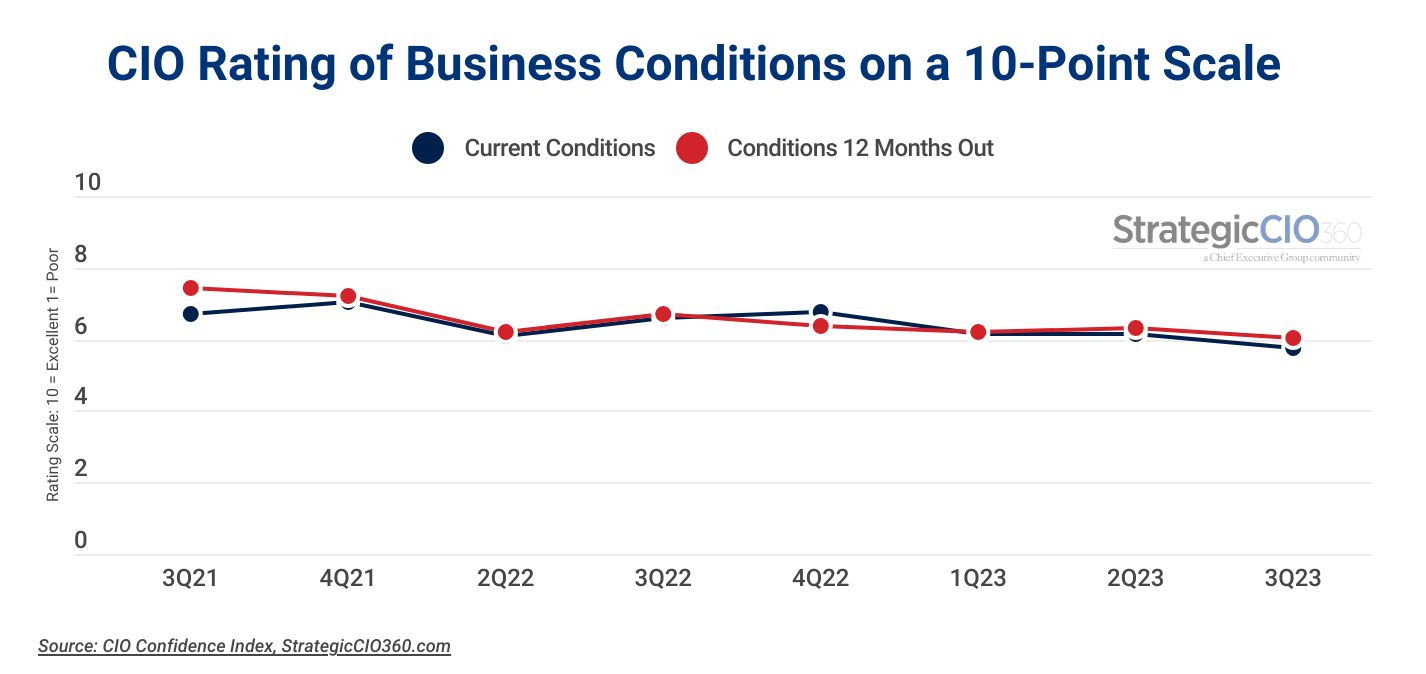

At 6.05, our forward-looking indicator, which measures on a 10-point scale (where 10 is Excellent and 1 is Poor) CIO sentiment for business conditions today and over the year ahead, is now at the lowest level on record since we started the Index in August 2021. Our reading shows a 4.5 percent decline in optimism since the second quarter, as CIOs forecast headwinds for the months to come.

Even when looking at current conditions, CIOs are giving the current business environment a 5.8 rating. That’s 6 percent lower than last quarter—and also the lowest level since the Index’s inception.

Those polled say the ongoing shift in the market combined with a growing number of inhibitors to execution on technology projects and tighter budgets are putting a damper on their confidence for the future. While most observed that slowing inflation is a good sign, there is still a great deal of uncertainty that is keeping companies on the defensive—and budgets tight.

“There’s lots of market change, lots of inhibitors to execution on projects,” said one respondent. “As well as tighter budgets and attention to austerity.”

“The current capital market environment and ‘work from home’ are having a big impact on us today,” said another one of the CIOs surveyed. “I feel like both of those things will trend back to favorable over time, just slowly.”

Like many others, while he expects his technology budget to increase in the year ahead, he nevertheless forecasts the company’s revenues and profits to be slightly down.

Adding to this perspective is the cost of labor and the fact that many are understaffed and unable to execute strategies as planned. And it’s not looking like hiring is picking up for technology departments either. Only 49 percent of CIOs participating in the survey said they were planning to add to their team’s headcount in the year ahead—down from 62 percent who had planned to hire new teammates just last quarter.

For the first time since the Index’s inception, the proportion of those planning to add to their team is now the same as those who are pausing hiring for the time being. The good news, perhaps, is that the proportion of those planning to cut positions declined drastically, by 78 percent, to a bottom of 3 percent.

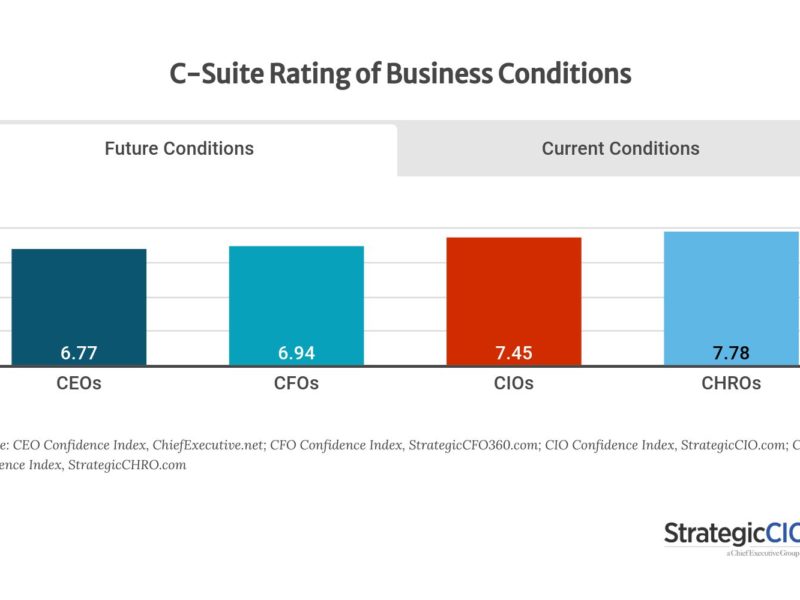

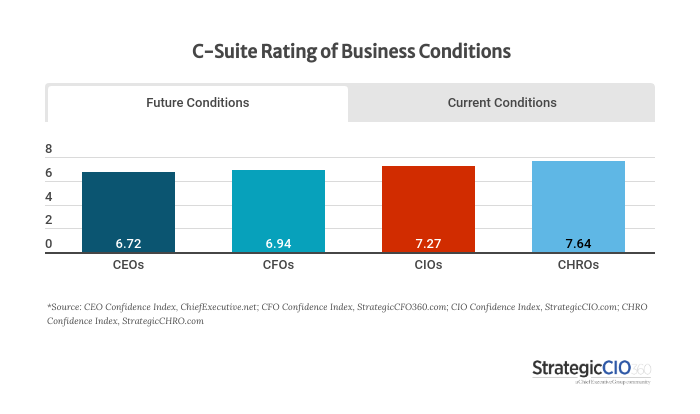

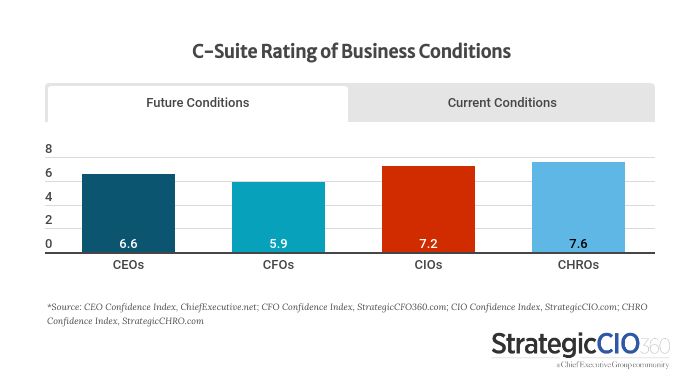

Still, while CIOs may have downgraded their forecast for the year ahead, 44 percent nevertheless said they believe conditions would improve. That’s not a majority, but it’s a significant jump from the 25 percent who felt the same last quarter. Similarly, nearly every other member of the C-Suite has also shown increasing optimism for the year ahead this quarter.

Allocating the IT Budget

The great majority (90 percent) of CIOs say their tech budgets will be increasing in the next 12 months, compared to 80 percent who, in Q2, had expected that to happen. But the areas where the capital is allocated have changed.

While 84 percent of CIOs confirmed they will continue to increase investing in cybersecurity in the year ahead—on par with the proportion who said the same in Q2—only 72 percent said they would do the same for their cloud infrastructure. That proportion is down 7 percent since Q2.

But where our survey shows an even greater change is with respect to automation: 85 percent of those polled in July said they plan on increasing their investment in automation this year, up from 74 percent in Q2.

“Increased efficiencies through technology and increased automation and AI are the only factors likely to improve the situation,” noted one of the CIOs participating in the survey.

When asked where they see the greatest benefit of automation for their company, 62 percent said marketing and customer service, followed by operations and back office, at 59 percent.

In comparison, when we asked CEOs the same questions in July, much smaller numbers saw opportunities for marketing/customer service (45 percent).

Perhaps there is a valid reason for this: while two-thirds of CIOs identified the biggest danger of automation to be the risk of introducing new errors/misinformation (vs. only 44 percent of CEOs who felt the same), CEOs listed “lack of human touch” as their top concern with AI.

About the CIO Confidence Index

The CIO Confidence Index is a pulse survey of CIOs and technology chiefs on their perspective of how current events are affecting their companies and strategies. Every quarter, StrategicCIO360 surveys CIOs across America, at organizations of all types and sizes, to compile our CIO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, cyber and tech investments, and IT staffing for the year ahead. Learn more at StrategicCIO360.com/CIO-Confidence-Index.