America’s Chief Information Officers’ outlook for business continues to steadily decline. Their reasons for pulling back their confidence lie in continued supply chain issues, persistent talent shortages (especially in IT) and political pressures surrounding midterm elections—similar to why CEOs and CFOs have also pulled back their ratings. Yet CIOs remain more hopeful and their rating has declined at a much slower pace than others in the C-Suite, encouraged by increased investments in both tech and cybersecurity.

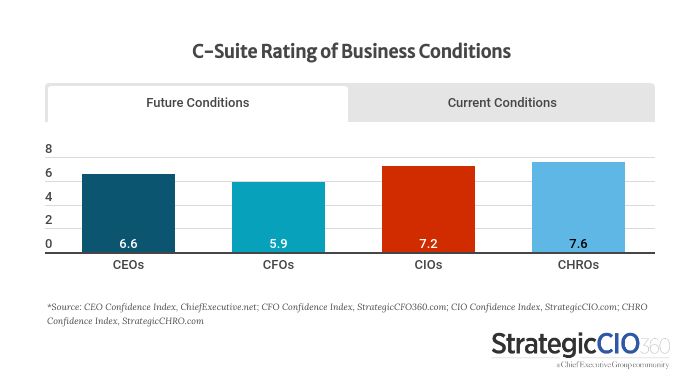

That’s the October briefing from StrategicCIO360’s latest CIO Confidence Index poll, part of an ongoing effort by Chief Executive Group to measure the outlook, challenges, priorities and areas of focus of public-company directors, CEOs, CFOs, CHROs—and now CIOs. In our October survey of 84 CIOs, conducted the week of October 25-28, 42 percent say they expect business conditions to improve over the next 12 months, rating them a 7.2 out of 10, or “very good,” according to our 10-point scale, down only 1 percent since last month.

Their rating of current conditions remains unchanged in October, at 7.0 out of 10, and far above the 6.1/10 rating that CFOs gave current conditions when asked earlier this month.

CIOs blame their decreased confidence on chatter of increased government spending, worries over stagflation, IT staffing shortages and supply chain issues. Yet they remain hopeful due to rising investments in cybersecurity and tech, outcomes of the conditions brought on by remote work due to Covid-19, which they also believe is primarily in the rearview mirror.

The plurality of CIOs still believe that conditions will improve, at 42 percent, dropping only 1 percent since last month. Their predictions on whether conditions will remain the same or decrease have also remained similar, with 24 percent predicting worse off conditions (up from 21 percent in September) and 34 percent predicting no change (down from 37 percent last month).

Bharat Amin, EVP & CIO of Huntington Ingalls Industries, an aerospace and defense company, says, “I hope Covid-19 will be behind us. We have started incorporating a lot of learnings from this pandemic and it is going to make our business efficient and effective.” He is hopeful that conditions will improve, rating them an 8/10 currently and expecting a 10/10 business environment 12 months from now. He speaks for many CIOs who share that they have created new processes through the pandemic, striving to make their business more effective. They hope to keep these practices in place going forward, all while hoping that the pandemic is fully behind us.

John Slaski, VP of Technology at TMEIC, a high-tech industrial automation company, shares Amin’s optimism. He rates current conditions at a 7 out of 10 saying, “Slow Covid recovery is affecting our revenue stream,” but is hopeful they will increase to an 8 out of 10 because, “we do see delayed orders and projects coming back in that timeframe.”

Some industries, however, are being hit harder than others.

“In healthcare, we are experiencing severe staffing shortages due to the combination of Covid and the economic conditions that the stimulus packages are creating,” says Patrick Wade, VP & CIO at Community Hospitals and Wellness Centers.

Tracy Tillinghast, CIO at Topa Insurance, says, “The job market is difficult. It is hard to find and retain talent. There is uncertainty with the virus and its impacts on the economy.”

Nonetheless, both are still hopeful that conditions will improve dramatically over the next 12 months.

The Year Ahead

CIOs have gained momentum in October on their predictions for profit, with 60 percent of them now forecasting gains, up 3 percent since last month. To counter, 3 percent fewer are forecasting increases in revenues since last month, now at 73 percent, down from 75 percent in September. CEOs disagree, with 3 percent more forecasting increases in revenues this month, now at 81 percent. Their predictions on profit remain unchanged since last month.

As far as IT staffing goes, 6 percent more CIOs are predicting increases in hiring, now at 62 percent.

In a stark change from last month, a higher proportion of CIOs are now predicting increases in both cybersecurity and tech investments, up 18 and 16 percent, respectively. Ninety percent of CIOs are predicting increased investment in cybersecurity and 88 percent are predicting increased investments in tech.

About the CIO Confidence Index

The CIO Confidence Index is a new monthly pulse survey of CIOs and technology chiefs on their perspective of how current events are affecting their companies and strategies. Every month, StrategicCIO360 surveys hundreds of CIOs across America, at organizations of all types and sizes, to compile our CIO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, cyber and tech investments, and IT staffing for the year ahead. Learn more at StrategicCIO360.com/CIO-Confidence-Index