Judging by the multiple rounds of layoffs at tech behemoths—and beyond—in recent months, it would be easy to assume things aren’t looking up for the sector.

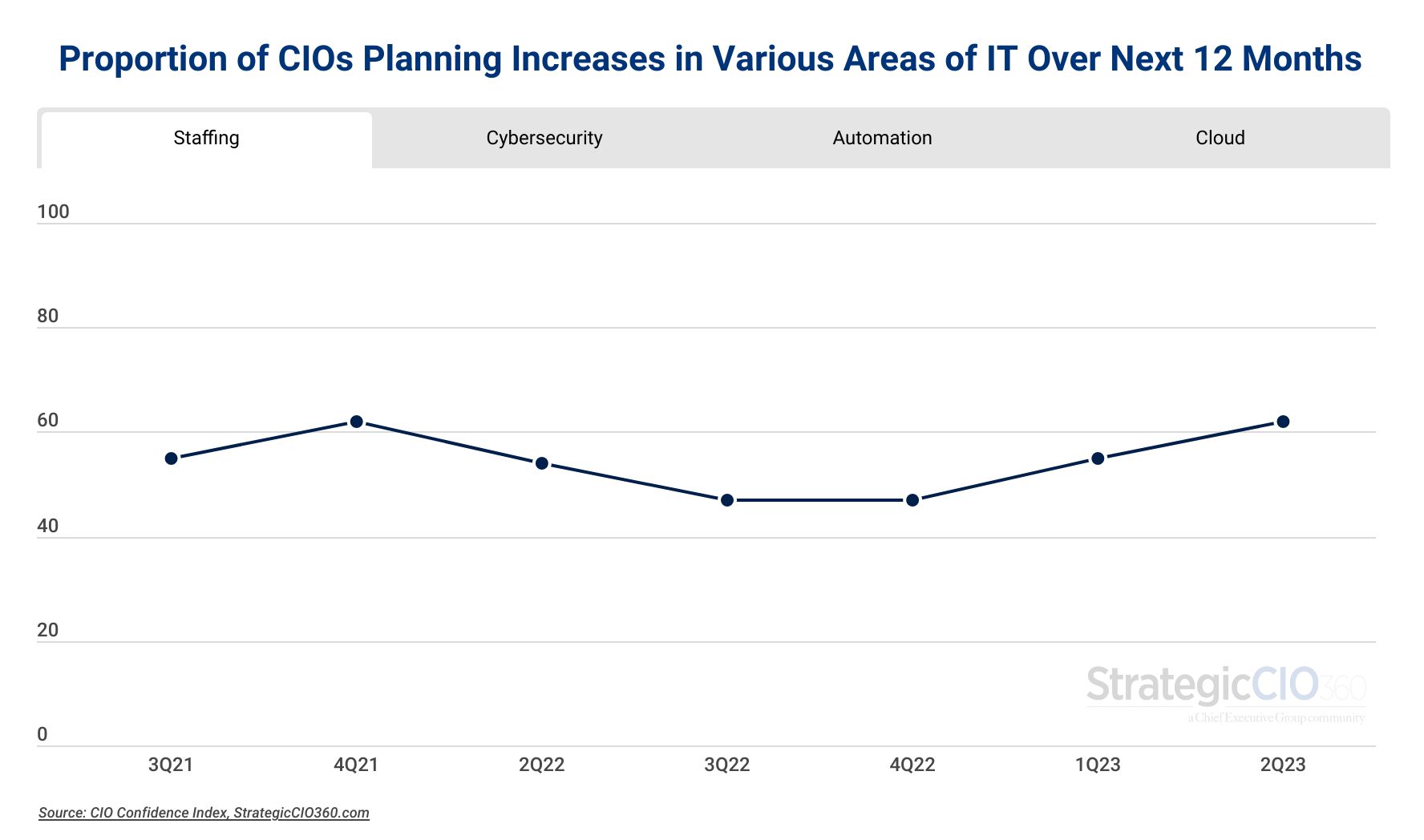

But StrategicCIO360’s latest reading of CIO confidence—a quarterly poll on CIO sentiment and strategies for the year ahead—finds America’s information chiefs instead planning to add to their teams over the course of the next 12 months, in great part due to increasing investments in cybersecurity and automation.

According to the poll conducted during the last week of April, 86 percent of CIOs at corporations of all sizes expect to increase spending on cybersecurity over the next 12 months, up from 80 percent the previous quarter when we asked the same question in February.

Similarly, 74 percent said they would ramp up investments in automation, up from 67 percent in Q1.

Those numbers are very telling of the important role new technologies play in the competitiveness of companies in the current environment because they come at a time of growing focus on cost containment. More than two-thirds of the hundreds of CEOs polled the first week of May said cost containment would be their priority for the remainder of the year, as they anticipate inflation to stick and consumer spending to stabilize.

But there are of course different ways to contain costs, and investing in cyber and automation doesn’t seem to be where cuts will be made. As a result, 62 percent of the CIOs participating in the poll said they would hire new employees over the coming months, up from 55 percent in Q1, and 45 percent said they had to recruit new staff specifically to execute their automation strategy.

And those don’t appear to be contract workers either. A quarter of those who said they’ve hired new staff to execute automation projects said all new hires were full-time employees, and another 41 percent said at least half were full-time.

All this activity may explain why when looking at business conditions 12 months from now, CIOs rate their expectation a 6.3 out of 10—where 10 is Excellent and 1 is Poor—2 percent higher than in Q1. (CIOs’ rating of current conditions, meanwhile, remained unchanged, at 6.1.)

Overall, while the outlook has improved, most polled CIOs said they didn’t expect significant change in the short term: 58 percent expect conditions in April 2024 to be fairly similar to what they are today, vs. 25 percent who expect them to be better—and 17 percent who said they will be worse.

On the Issue of Automation…

Among those CIOs who said their company was investing in automation, whether that amount had increased or not, only 4 percent said they had achieved their objectives. Instead, two-thirds said they were less than halfway through to their goals.

The biggest hurdles to moving forward, CIOs said, include “integrating/communicating with other organizational systems” (50 percent) and “pushing through legacy systems” (47 percent). “Maintaining ongoing IT support” and “managing cyber exposure and data security” came in third and fourth place on the list of challenges to automation.

That’s not to say things aren’t going well, though. Eighty-four percent said they had achieved positive ROI on the automation projects they had so far completed—and another 8 percent didn’t know—leaving only 8 percent who said automation had yet to pay off.

For now, most automation projects appear focused on the back office (66 percent) and finance (61 percent), with marketing and sales coming last on the list of priorities.

About the CIO Confidence Index

The CIO Confidence Index is a pulse survey of CIOs and technology chiefs on their perspective of how current events are affecting their companies and strategies. Every quarter, StrategicCIO360 surveys CIOs across America, at organizations of all types and sizes, to compile our CIO Confidence Index data. The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, cyber and tech investments, and IT staffing for the year ahead. Learn more at StrategicCIO360.com/CIO-Confidence-Index.