Faced with soaring labor cost inflation and shortages of key employees across nearly every industry, U.S. business leaders are increasingly turning to technology for answers, fueling a push for automation solutions unlike any in recent memory. That trend will only accelerate in the year to come.

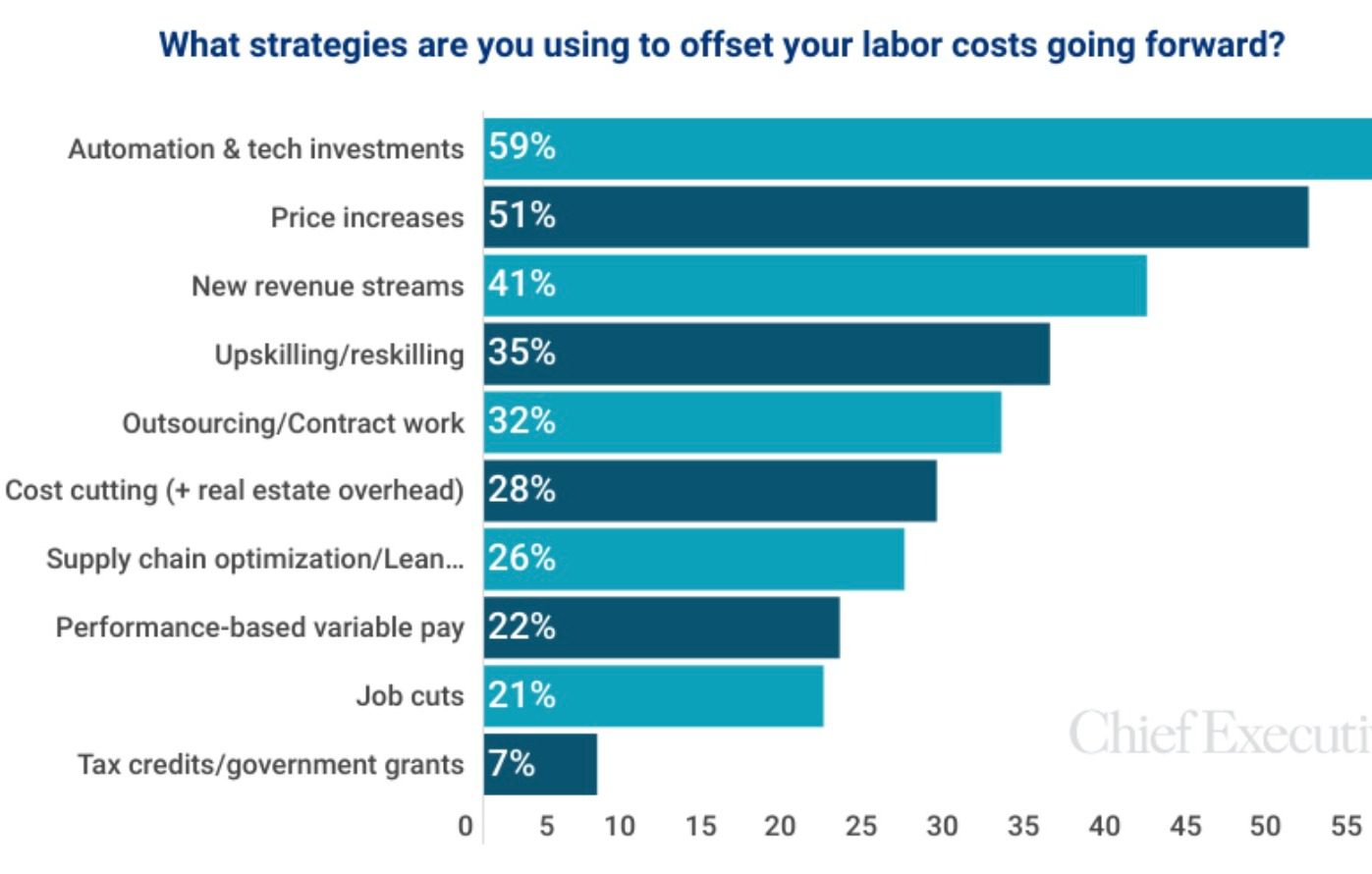

That’s the big takeaway from sister publication Chief Executive’s latest polling. Among the 182 CEOs surveyed November 7-9, 59 percent ranked automation and technology investment as the number one strategy they are pursuing to offset rising labor costs in 2024—even ahead of price increases, finding new revenue streams and reskilling existing workers.

Over the past year, compensation costs, including salaries, benefits and perks, increased 4.3 percent at U.S. private companies, according to Chief Executive Group’s latest report on compensation—versus an average of 3 percent annually prior to Covid. Meanwhile, new productivity-enhancing technology like generative AI has become far more flexible, intelligent and inexpensive to deploy.

“Digital transformation, specifically with enhanced workflow and elimination of redundant manual tasks are critical, as employers are seeking efficiencies in the back-office functions,” said Neville Kadimi, CFO at Diamond Wipe.

And according to George Casey, advanced analytics practice leader at consultancy RSM, even the top chief’s job is likely to get disrupted by these developments.

“In the past, we looked at automation in different types of roles, typically at the bottom pyramid, the bottom layer of menial task,” he said. “What we’re seeing [now] is that throughout the organization, the top-level jobs, our traditional ‘white collar’ jobs, are potentially more at risk because they have a greater return. For instance, a CEO who has a task that before took eight hours can now, with these productivity enhancements and AI, reduce that by 25 percent.”

Of course, that won’t automatically translate into a reduction in workers—or CEOs. Among those surveyed, 88 percent said they expected to displace less than 5 percent of their workforce with automation, and a full 40 percent said they did not expect technology to displace any workers at their firms, at least not in the next 12 months. No one responding to the survey expected to displace 15 percent or more of their workforce with technology.

Within this, though, there are significant differences based on company size, with executives at bigger companies having much larger appetites for adapting technology solutions versus executives at smaller firms. Some 62 percent of executives at companies under $10 million in annual revenues said none of their employees would get displaced by automation, for example, compared to only 9 percent at large companies ($1 billion+ in annual revenues).

If that pattern holds, it could broaden the already-wide productivity gaps between larger and smaller organizations, with large companies potentially using automation to slow workforce growth—and the highly inflationary costs associated with bringing people aboard—to a greater extent than smaller rivals. New advances in technology promise to make the existing workforce more productive at every level of the company–not just at the bottom rungs—so the greater the automation effort, the greater the overall advantage.

Still, Casey said, that productivity gain will require time and focused effort. It doesn’t automatically come from turning the “On” switch on a program, he said. “The technology’s available, which is great, but the ability to incorporate it into production workflows takes some time, time and thought leadership. We’ve got potential ROI, but something has to change to actually convert the capabilities to value. I think that’s where we’re going to see people learn more about what the actual return is versus just what’s potential.”