All executives must think about how the future will affect their business and envision strategies that align to trends and new areas of growth. A major trend of our time mirrors the transformation of the first industrial revolution. But instead of creating a net-new economy, it is remaking the existing economy in a way that is sustainable.

New innovations in climate tech are leading to a new boom in startups and the venture capital money that funds them. These startups are driven by growing consumer demand for green solutions, corporate ESG goals, and government regulations and funding that is laying fertile ground for this new stage of growth.

But how is this fledgling industry performing in comparison to the conventional market, and how does it differ from the “cleantech 1.0” market of the early 2010s? Climate Tech VC, a research firm for investments in the new climate economy, published its annual report, noting that VC investments in climate tech were down slightly in 2022. However, looking more broadly provides a wealth of context and optimism for the sector.

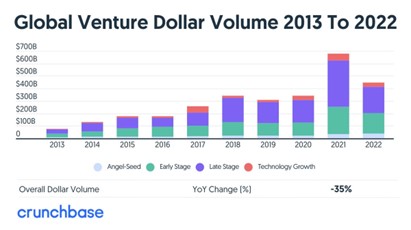

Despite the fact that climate tech funding from VCs decreased 3% in 2022, VC funding overall was down a shocking 35%. In addition, 2022 was the second-best year for startup fundraising on record, second only to the post-pandemic splurge of 2021. This shows an overall increase in funding for innovation overall, and green innovations specifically.

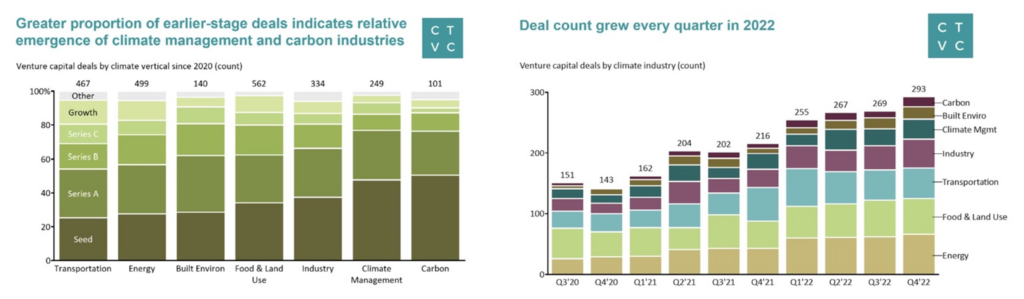

Total global VC investments raised $445 billion in 2022, with $40 billion of that going to 1,000 climate tech startups. Despite being a much small portion of total funding, the number of deals in climate tech increased, and investments shifted to more early-stage companies. This funding also diversified, with more funding going to innovators in more industries. Long-standing contenders like transportation, and food & land use stayed strong but declined somewhat, while energy rose a quarter. But newcomer industries like climate management, built environment, and carbon skyrocketed 50%, 151% and 305%, respectively. This growth in diversification shows that more areas of the economy are being transformed through climate tech innovation, and we should expect to see disruptions and opportunities rapidly emerging in these areas.

This sustainability transformation is not simply taking place in the world of startups, it’s also affecting traditional markets like automotive. While auto sales declined 8% between the first half to 2021 to the same period in 2022, electric vehicle (EV) sales surged 62%. China more than doubled sales. While the U.S. diesel generator market is growing at around 7% CAGR, battery energy storage, often used to support solar and EV charging, is growing at a rate of 31%. Solar energy is growing at a rate of 34% YoY, and renewables are projected to account for 95% of all energy power capacity growth through 2026.

The writing on the wall is clear, and executives who are plotting out their strategies for the coming years would be well advised to incorporate sustainability and climate tech into not only their internal operations, but into their market-facing strategy. Many already are, as we can see from climate tech exits (acquisition or becoming public). 289 climate tech startups have exited since 2020, increasing 70% YoY over 2021 and 2022. Transportation and energy led the pack, with 64% of all climate tech exits. Given that these two industries account for around half of all carbon emissions, this is great news for the environment.

M&A has picked up as SPAC exits have lagged, and only a small percent going IPO. Corporates acquired the majority of startups at 105, with private equity and other startups leading similar numbers of acquisitions 27, and 26, respectively, showing that larger players are jumping into climate tech to take advantage of innovations and enter rapidly growing markets. For founders, exits generally take around seven years to exit via IPO, versus nine years for M&A or SPAC.

As we enter this new nine-to-ten-year cycle of startup founding to exit, Climate Tech VC estimates that we are less than halfway through and should expect a wave of exits beginning around 2026. Corporates that are looking to the future will be tracking climate tech innovations and potential acquisition targets over the next few years, before competing over the top startups that deliver them a slice of the sustainability transition market pie.

The sustainability transformation is well underway, and it will enable a new era of sustainable abundance for the world. In the process, it will also create incredible opportunities for startups, corporates and professionals who not only want greater meaning in their work, but who want to thrive financially by doing so. Studies show that companies that incorporate climate and social benefits into their core business perform better, enjoy lower costs of capital, operate in faster growing markets and retain employees at higher rates. The transition to a sustainable global economy is a great development for the environment and our society—and also for executives who know a good opportunity when they see one.