Until now, CIOs, for the most part, haven’t been feeling the brunt of the economic storm—at least not directly. Amid various enterprise-wide cuts and budget freezes, the IT function has been relatively unscathed, mainly due to how vital technology has become for business, particularly with ongoing labor shortages. Q4 data shows things may be changing.

Data from StrategicCIO360’s fourth-quarter poll of U.S. CIOs finds outlook for business is shifting downward, down 5 percent in our October reading compared to July levels. Though at 6.4 the Index (which measures CIOs’ level of optimism in business conditions for the 12 months ahead on a 10-point scale) remains 2.5 percent ahead of Q2’s 6.2 reading, some of the CIOs polled say that economic uncertainty is starting to make clients more hesitant to make changes, decisions or new investments, thus affecting revenues—and forecasts—for the short term.

“Definitely concerned that economic conditions could worsen and impact the overall business environment, driving a reduction/freeze in IT spend,” said a chief technology officer participating in our survey fielded October 17-20.

The rising cost of talent is also cited as a factor affecting IT budgets, with about three-quarters of polled CIOs saying not only is finding experienced tech talent more challenging today but starting wages have also increased astronomically. In fact, 55 percent say finding tech employees who truly grasp the needs/realities of business is difficult—not to mention that retaining them is much harder than it was just a few years ago. All of this comes at a cost to the business.

“It is taking up to 5 months or more to fill a position whereas prior to the pandemic it would take on average 30 days.”

“Everyone expects compensation to be adjusted for inflation; total rewards are undervalued compared to salary,” said the technology director of a public healthcare company.

“Dramatically fewer candidates applying for posted positions,” said the CIO of a mid-sized organization in the education sector. “All want more money than we allocated, [and] most applicants do not meet most posted qualifications.”

“Employees have technical skills but limited understanding of business and industry knowledge. Makes it tough to get productive apps accomplished,” said the CTO of a small PE firm.

And while many say the push to automate is giving them hope companies will be able to circumvent staffing shortages sooner rather than later, automation investments are on the decline: 72 percent of CIOs polled in Q3 had said they were planning to increase their automation spend in the year ahead; that proportion is now down to 53 percent in Q4.

Temporary Turbulence

Overall, CIOs remain optimistic that even if demand slows, the moment will only be short-lived, and many expect volume to bounce back to pre-Covid levels as inflation slows.

“Lots of deals are in the works,” said one CIO at a mid-sized consultancy in the Southeast.

“Healthcare will remain healthcare. Elective procedures can be delayed, but not forever,” said another respondent who’s hopeful this slump will not last.

“We are in logistics, expecting a slowdown in Q4 and into next year,” said the CIO of a large transportation company.

Case in point: Only 11 percent said their company was making budget cuts in IT to help curb the impact of inflation. Instead, 44 percent said they were increasing their tech spending to seize opportunities in the current market—and 20 percent said they are staying the course and not reacting one way or another to the volatility.

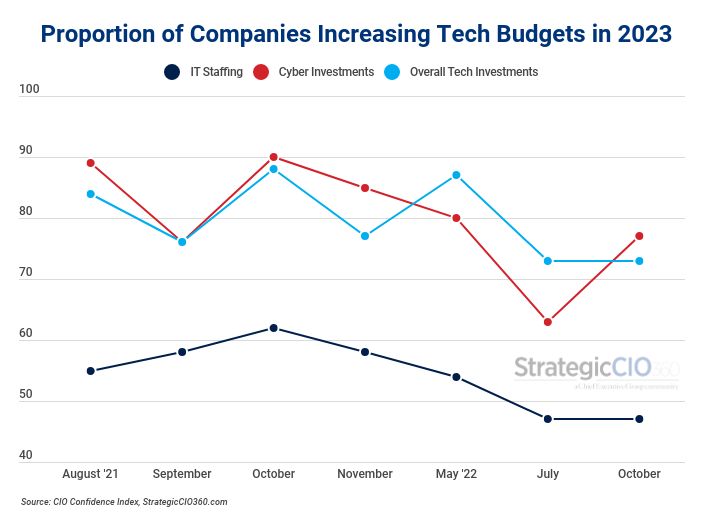

So, where are CIOs focusing their capital in 2023? According to our poll, 77 percent plan to increase cybersecurity spending (up from 63 percent in Q3), 58 percent are investing in the cloud, 53 percent in automation (down from 72 percent in Q3) and 47 percent in staffing (unchanged from previous quarter).

Overall, the outlook shared by CIOs is fairly aligned to what we’ve observed among CEOs and CFOs earlier in the month. Our CEO Confidence Index, conducted by sister publication Chief Executive, and our CFO Confidence Index, fielded by StrategicCFO360, also pointed to a potential deterioration of business conditions in 2023—though they, too, expect it to reverse quickly.

About the CIO Confidence Index

The CIO Confidence Index is a pulse survey of CIOs and technology chiefs on their perspective of how current events are affecting their companies and strategies. Every quarter, StrategicCIO360 surveys CIOs across America, at organizations of all types and sizes, to compile our CIO Confidence Index data (October poll had 66 participants). The Index tracks confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, cyber and tech investments, and IT staffing for the year ahead. Learn more at StrategicCIO360.com/CIO-Confidence-Index.